Hover your mouse over images above to navigate through the slideshow.

In October 2012, Superstorm Sandy hit land and became one of the costliest storms in modern history. Not only did homeowners acutely feel the impact, many small business owners were also affected. The Federal Emergency Management Agency estimates that 40 percent of small businesses fail to reopen after a disaster, saying just a few inches of water can cause tens of thousands of dollars in damage.

At the one-year anniversary of Superstorm Sandy, it’s important to remember that most standard business insurance policies do not cover flood damage, yet 90 percent of all natural disasters involve some form of flooding, according to the Insurance Information Institute.

Some insurance companies may offer this coverage for additional cost or will refer customers to programs like the federal government’s National Flood Insurance Program. Erie Insurance strongly encourages business owners to talk to their insurance agent about this important coverage.

“Obtaining flood insurance is one of the most important things a small business can do—particularly if the business is located in an area at risk for hurricanes, which we know includes the Northeast, not just the Eastern Seaboard and southerly coastal areas,” said Christine Lucas, vice president and commercial product manager at Erie Insurance.

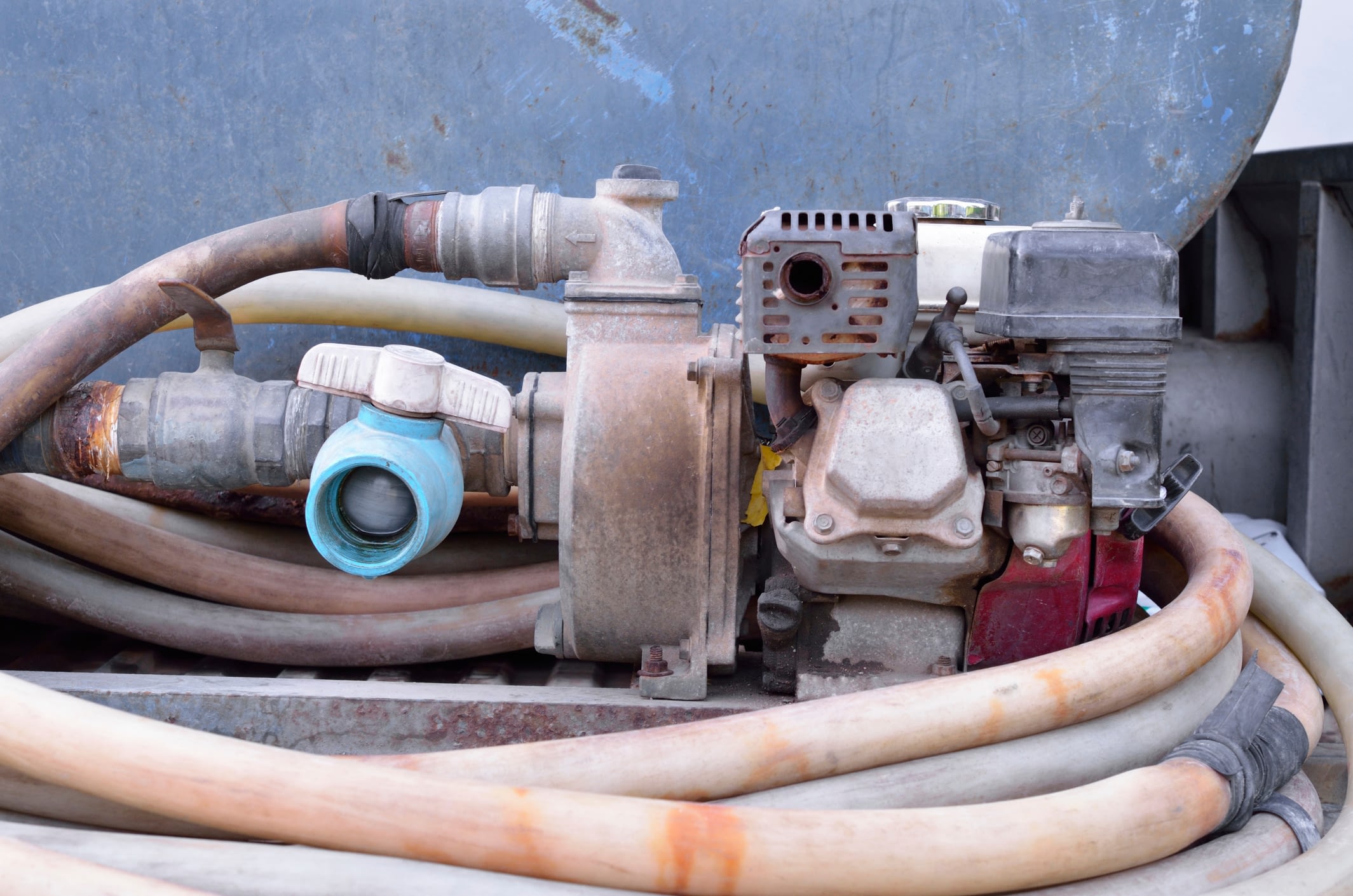

Beyond flood insurance, there are several other coverages available through private insurers such as ERIE that can help a business get back on its feet after a disaster. Flip through the photo carousel above for seven coverages ERIE business customers were grateful they had after Sandy’s wrath—and that other businesses may want to consider obtaining before the next big storm.

As with all insurance products, there may be additional terms, conditions and exclusions not described above, so ERIE recommends having your insurance agent review your policy. Your agent can help you understand what is available with a standard business policy, what additional coverage you should consider, and the specific coverages and exclusions on your policy.

Read the full story from Erie Insurance: “Seven Important Business Insurance Options to Consider Before the Next “Sandy”“

Filed Under: Business Insurance, Insurance News